Have you just started your business and looking to track all your transactions? Is it getting hard for you to pay invoices on time? Then, Wave Account software is an ideal accounting platform you’ll need for your small business.

Every business needs a platform that records transactions like business purchases, invoices, and payroll.

Today, We’ll discuss the tips for Wave Accounting, how to use it, and the prices.

Without further ado, let’s leapfrog into it.

What is Wave Account Management Tool?

Wave Accounting is software for small startups requiring financial services for their business. It helps to understand, clarify and analyze the financial issues of your business.

It manages your invoices, transactions, payrolls, accounts, bills, and many more. It maintains your account book pretty well.

H&R Block launched the software; the headquarter is based in Toronto, Canada, and embarked on 16th November 2010.

Note: Wave Accounting is available only for United States and Canadian businesses. Check alternatives like FreshBooks or QuickBooks if you are here from another country.

How to use Wave Accounting?

Wave Accounting is a user-friendly software you can use on the web. Additionally, you can download their mobile application on your android or IOS.

To manage your business through Wave Accounting, follow these steps.

- Sign in on their page to get started.

- After that, it will direct you to provide information about you and the business, such as names and the purpose. You can choose the currency and your country (the US or Canada).

- The next step is choosing a starting point for why you are using the Wave account.

- After all adjustments, it will request you to answer the questions according to your selected starting point.

- Click “Continue” after answering all the general questions, and you will see the dashboard, which displays your cash flow.

How Much does Wave Accounting Cost?

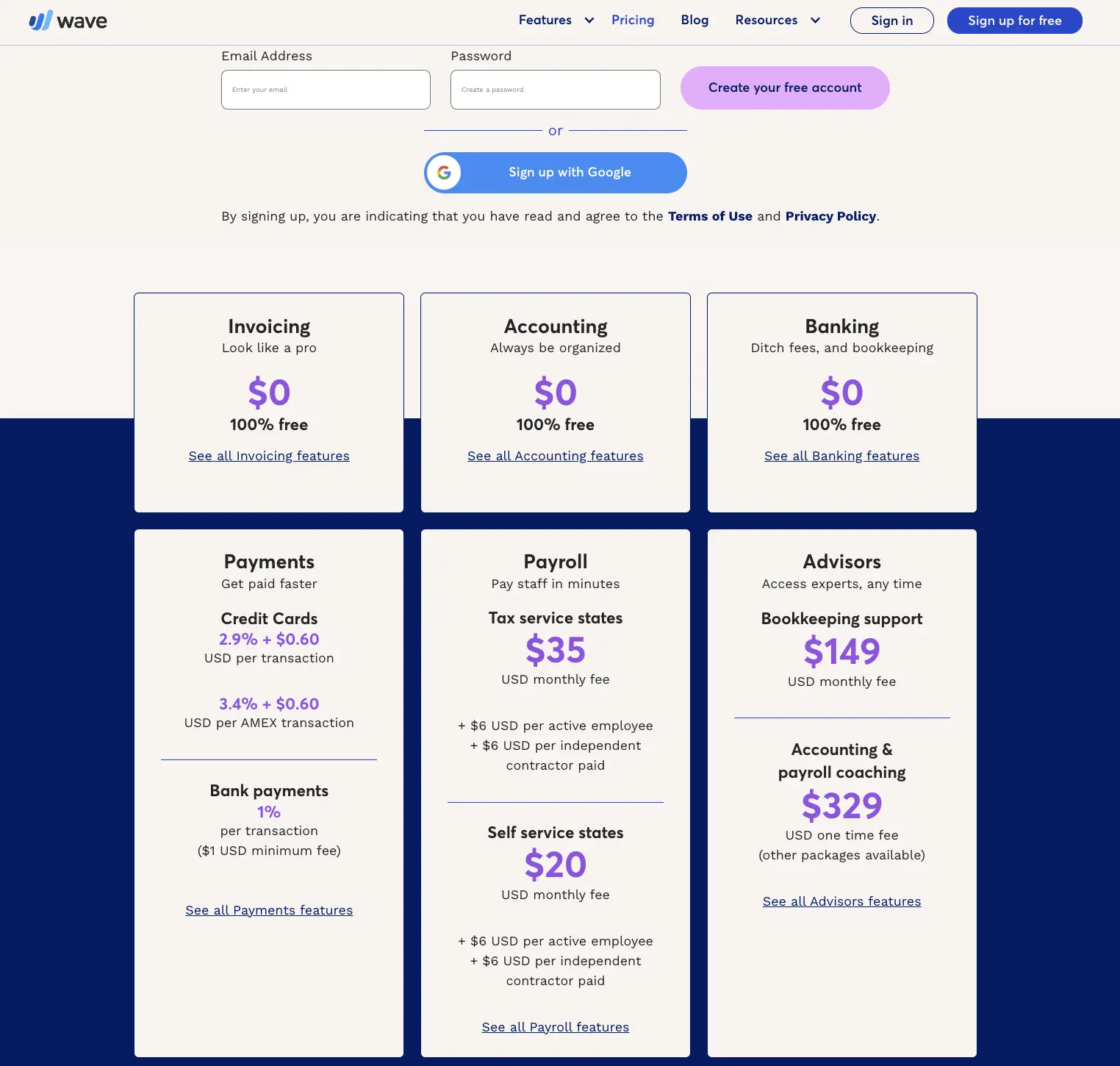

Invoicing, banking, and accounting costs include no charges at all. However, there are charges for payment transactions and staff payrolls. Let’s discuss the costs.

Payments

- For payments, there is 2.9% + $0.64 for every transaction on credit cards such as Master Card, Visa, etc.

- There is a $1 charge per bank account transfer for bank payments.

- Your cash will be transferred in 1 business day for Canadian users and 2 days for US users.

Payroll

- For Tax Service State, there is a $35 monthly fee ($6 per employee & $6 per independent contractor).

- For Self Service State, there is a $20 monthly fee ($6 per employee & $6 per independent contractor).

Besides, you can pay $149 for bookkeeping support and $329 for Accounting and Payroll coaching from experts.

Wave Accounting Vital Tips

Let’s hear some of the tips of Wave Account software.

Connect Bank Account

You can add a bank account to Wave, making the proceedings faster and saving time. It will export all the transactions to your Wave account.

Create Customer Account

On the left navigation bar, see options regarding payroll, invoices, and other accounting features.

To create a customer account, select Sales and tap Customers. It will direct you to add customers. Fill up the form by providing basic information about the account, such as Email, Phone, and Billing.

Date Filter

If your screen looks bulky, you can filter the dates to narrow down the results on your page. It will also help you save time.

Does Wave Invoicing Report to IRS?

Yes, it does. When you reach the minimum requirements set by IRS and receive payments from Wave, you’ll get a 1099-K form from Wave.

Does Wave Charge a Fee for Invoices?

As mentioned, Wave offers free use of invoicing, accounting, and banking features. You will be charged if you pay through Wave, though.

Final Words

In a nutshell, Wave Accounting saves time by managing your business financial book. The software is only for US and Canada. Check alternatives like FreshBooks or QuickBooks if you are reading from another country.

More any ideas on the way of freelancing? Take a look at freelancer. Guide!