You probably know that making international payments is expensive and time-consuming. The good news is you have a better way to make international transfers and payments…Wise!

Let's see how this top-tier international payment service, Wise, makes it hassle-free for you to send and receive payments around the globe.

What is Wise Payment?

Formerly known as TransferWise, Wise is a money transfer service that allows users to send and receive funds internationally across 50+ countries.

Supporting almost 54 currencies, Wise is a convenient, affordable, and fast way to send and receive money internationally. Their excellent exchange rates and low fees make Wise the best option for every type of money transfer across borders.

Wise app is available on App Store for iPhone and iPad and on Playstore for Android.

Top Features

If you're looking for an easy and affordable way to send money abroad, you can't go wrong with Wise. Here are some of the top features that make TransferWise stand out.

- Wise (TransferWise) charges significantly lower fees than most other money transfer services.

- Wise supports over 50 different currencies to transfer payments.

- Your money will typically arrive at its destination faster than most other money transfer services, usually in minutes.

- Wise uses the latest security technologies to keep confidential details and payments secure.

Overall, Wise is the best choice for anyone looking for a cost-effective and convenient way to send money anywhere in the world.

Is Wise safe?

There is no doubt that Wise can be trusted as an industry standard for sending and receiving funds safely. Regulated by the FCA, this trustworthy organization has been recognized by the Better Business Bureau (BBB).

So you can feel reassured knowing your private information will remain protected thanks to the latest security technology used by Wise.

6 Top Tips to Get the Most Out of Wise?

Here are some top tips and tricks to use Wise like a pro and get the most out of it.

- When you sign up for a Wise account, use your personal email address to keep your information private and secure.

- Always double-check the recipient's name, address, and bank account details before confirming the transaction to avoid any mistakes that can cause delays or problems with the payment.

- If you're sending money to someone in another country, be aware of potential currency conversion fees that may apply. These can sometimes add up, so check the rates in advance.

- Keep an eye on the exchange rates to get the most out of Wise while making international payments.

- When using Wise, remember that there may be limits on how much money you can send in each transaction. Be sure to check these limits before making a transfer, as exceeding them could result in additional fees.

- Finally, if you ever have queries or issues, don't hesitate to contact the Wise Support team.

Is Wise Good for International Money Transfer?

To answer this question, you need to look at what Wise offers and how it compares to other money transfer providers.

Wise provides a peer-to-peer money transfer service that uses the mid-market exchange rate, so you always get a great deal. They also don't charge any hidden fees, so you know exactly how much you're paying - unlike some banks that hide fees in the exchange rate. And if you need to send your money abroad in a hurry, Wise can do it faster than most - sometimes in just minutes.

So, overall, Wise is one of the best options for international money transfers. Their low fees and fast transfers make them ideal for anyone who needs to send money abroad regularly or in large amounts.

How to Open a Wise Account?

- Visit Wise

- Click Register

- Create a new account with your email and select your residence country.

- Add bank details and other information.

Is It Free to Use Wise?

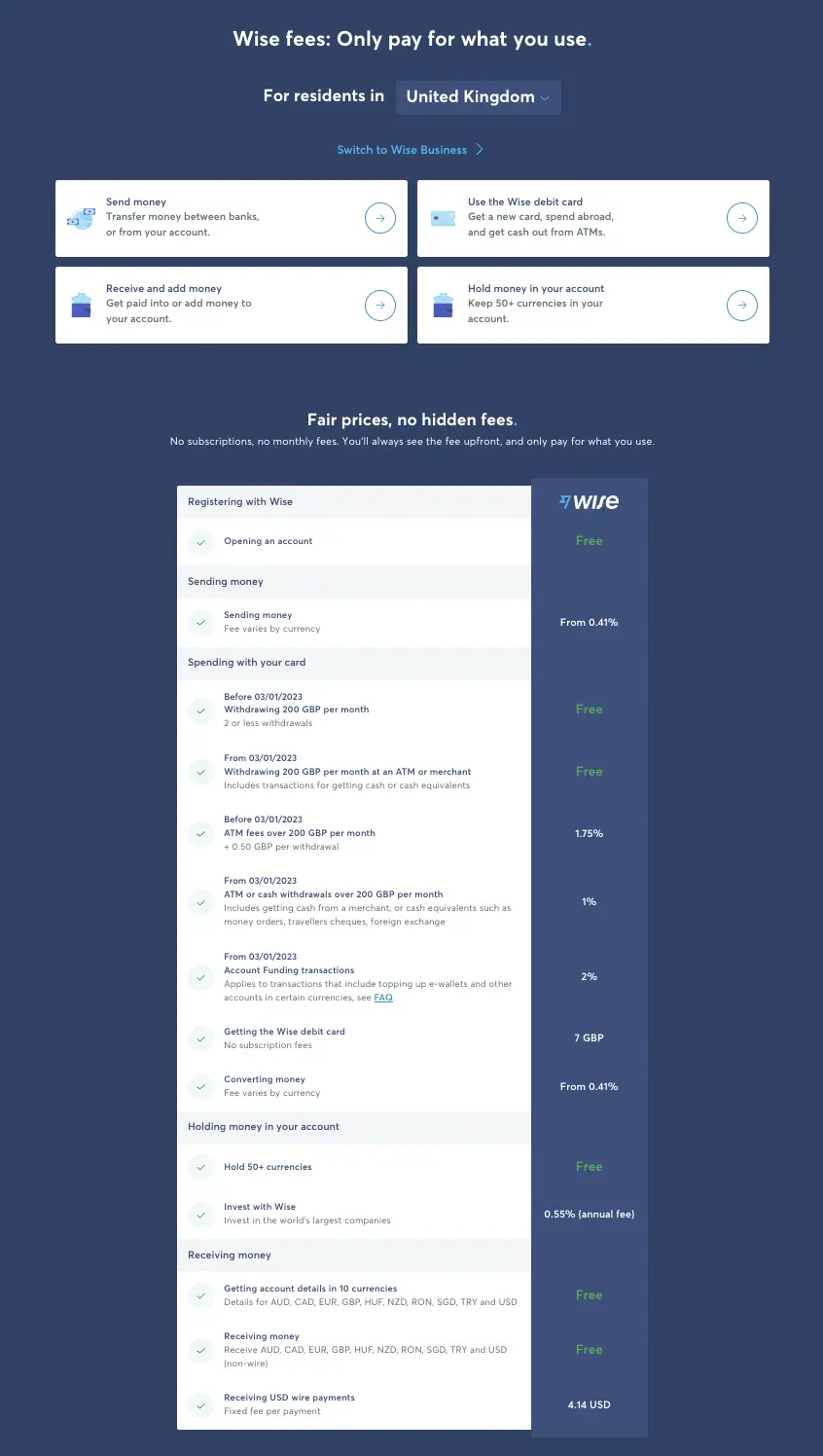

Yes, it is totally free to use Wise without any paid plans, but you are charged for various processes.

Wise Fees

- Send Money: - at 0.41%

- Investment - 0.55%/annual

- Receiving USD - $4.14/payment

Conclusion

With Wise, you can make international payments and transfers that are fast, easy, and low-cost, even for the minimum amounts. Once your money arrives in another country, it can be spent instantly in that country's currency.

In short, Wise makes it easy to transfer funds worldwide. So create your Wise account now to send money via Wise around the globe.

Don't forget to check out our other articles on freelancer.guide about other valuable tools to boost your business.