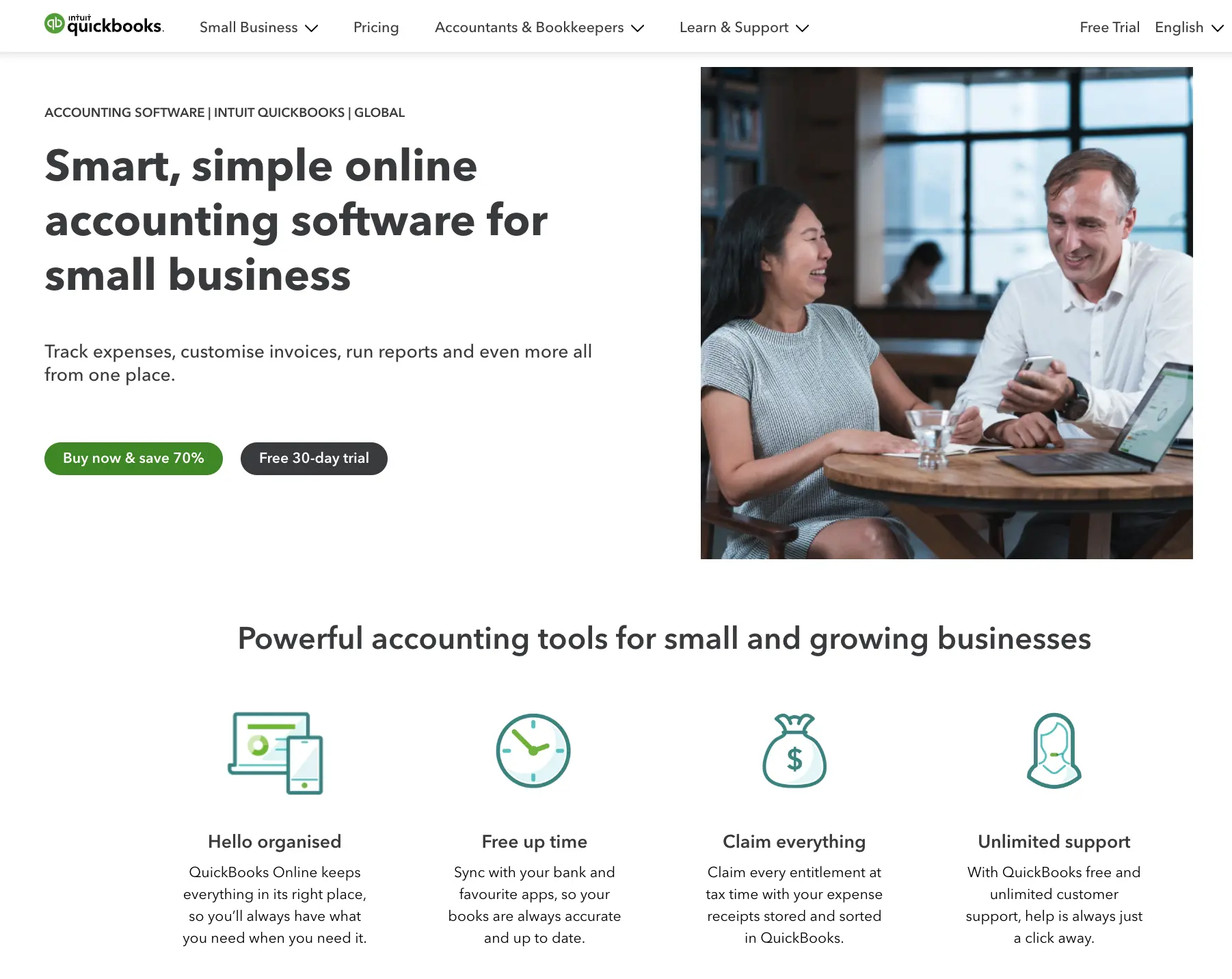

Accounting is one of the most confusing and time-spending sides of growing businesses. Tracking income and expenses, invoicing, and payment may end up with a knotty problem at the end of the day.

Quickbooks comes in handy with so many features to manage accounting issues automatically. Let’s check what the software offers.

What is Quickbooks Used For?

The software is specialized in small to medium businesses to organize money in and out.

Automated solutions for payments, accounting, and other financial matters make keeping everything in a good place easier.

Is Quicken or Quickbooks better for my business?

Even if there is a comparison between Quicken and Quickbooks, the answer depends on what you look for. Quicken is a personal accounting manager. It’s a handy tool if you want to economize and see what comes and goes as an individual or a family.

On the other side, Quickbooks is a professional tool that was launched with the purpose of small to medium companies. Also, it’s an excellent way to track your income and expenses as a freelancer.

Is Quickbooks Free?

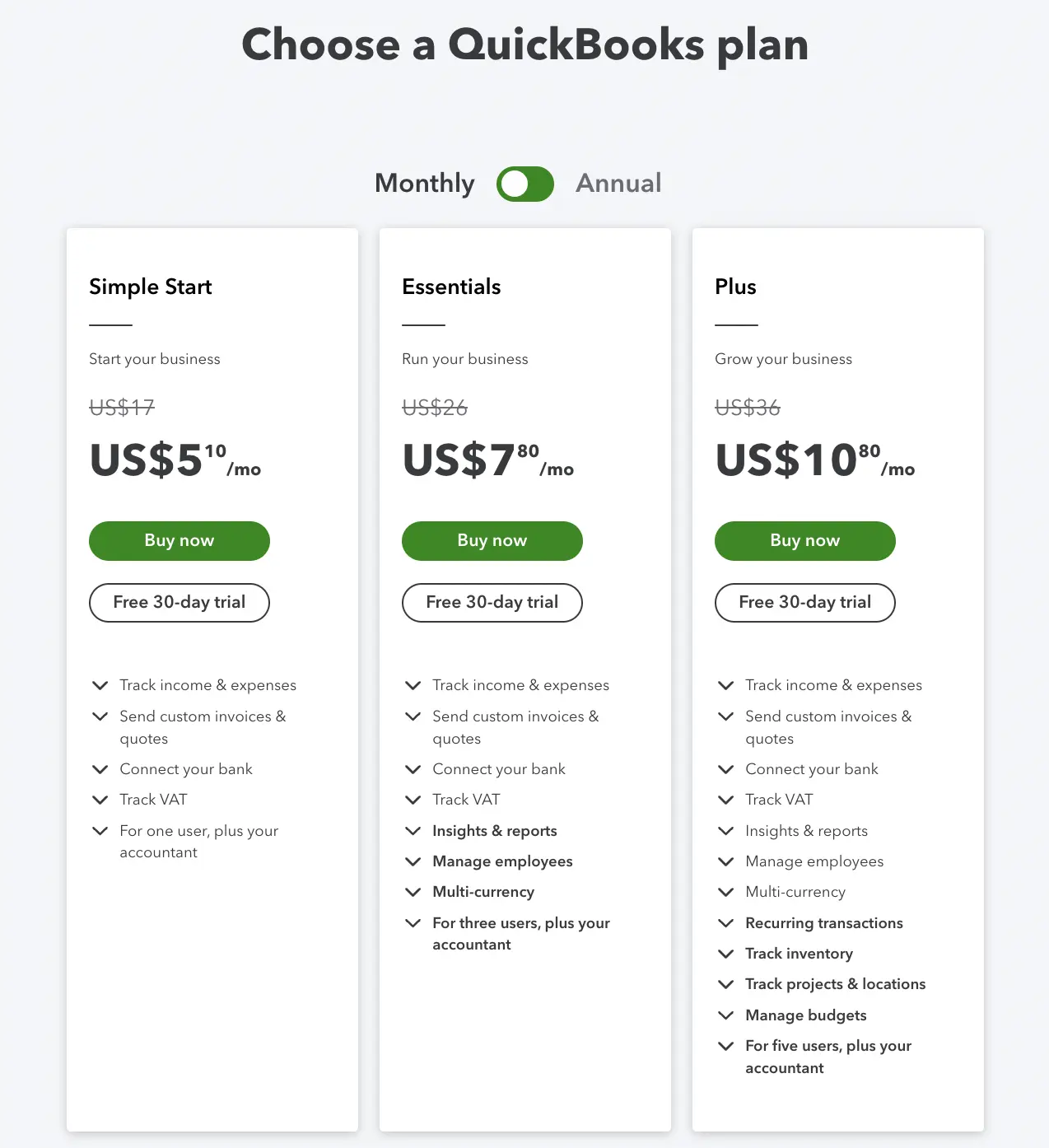

Quickbooks has a free 30 days trial for new users. Then, you need to pay at least 5 USD per month for the “Simple Start” plan.

Top Tips and Tricks to Make Use of Quickbooks Effectively

- Quickbooks offers a 30-day trial, so give it a try and see if it is worth purchasing or not. Also, you can learn how to make use of it better.

- There’s a quiz for new users. Choose the best options for you and see the most convenient plan. Quickbooks has options for a variety of businesses.

- Quickbooks Desktop: Finance Management for Small to Medium Businesses (SMBs).

- Quickbooks Online: Finance Management for Small to Medium Businesses with flexibility.

- Quickbooks Self-Employed: Such features like “Track Mileage” deduct your expenses effectively and help save money at tax time for people working with Uber and Lifty. Additionally, it is a smart way for any Freelancer.

- Automated Invoicing saves you from calculations and mistakes. You can also print or email them to your clients.

- Connect your bank account and track your bills and other expenses. Also, You can add them manually in a few minutes.

- There are various reports such as “Profit and Loss”, “Balance Sheet”, and “Statement of Cash Flows”. You can print, email, or customize them. If not, you can keep them in the cloud.

- Employees and clients can enter the work hours throughout the day. It makes billing clear and more accessible.

- Taxes are easier with Quickbooks. All income and expenses are already stored there when the tax time comes. Moreover, you can permit your accountant to access your Quickbooks.

- Quickbooks Payments service provides online payments. Clients directly pay you with the email invoice.

- Take photos of receipts and upload them. You can attach them later to any email and invoice. Download the Quickbooks app for Android or iPhone.

- Quickbooks offers extra services software itself, such as Quickbooks Live. You can get a ProAdvisor for your needs. Check the official website to get more details.

Quickbooks is what you need in your business journey bag on the way. Getting the know-how from the beginning helps you a lot when figures become too high to handle alone.

We have tried to help you understand how to manage your money.

Keep reading freelancer.guide if you want to get some ideas on how to earn money.